The financial markets are changing at lightning speed. Remember when trading floors were full of people shouting, signaling papers, and making deals with hand gestures? Fast-forward to today, and much of that hustle has shifted to sleek digital screens powered by algorithms. Now, the real game changer is AI trading software. If you’ve ever wondered how technology is transforming investing, you’re about to find out why this is more than just a trend it’s a revolution.

Understanding AI in Finance

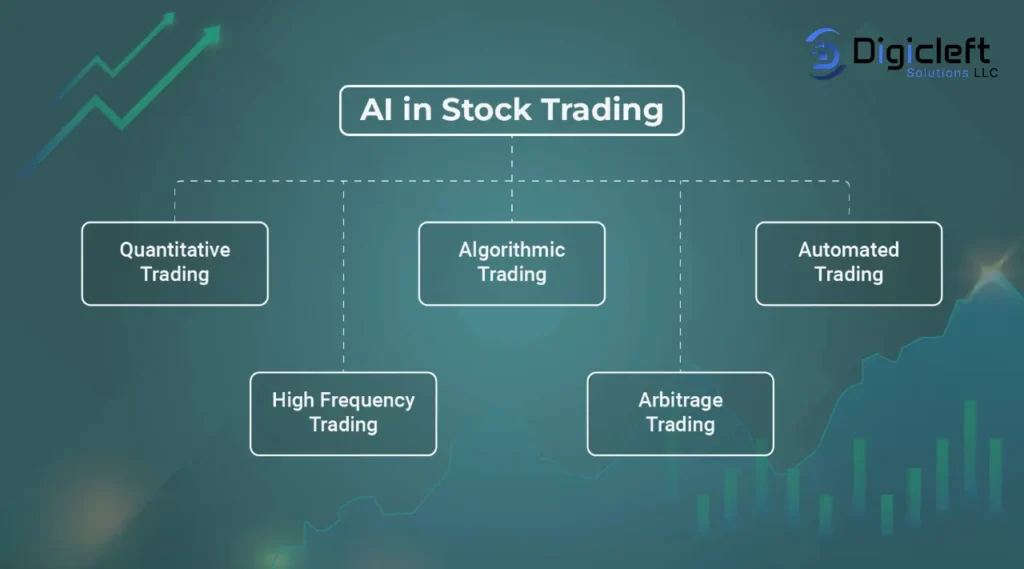

So, what’s the buzz about AI in trading? At its core, AI trading software uses machine learning, predictive models, and big data to make smarter investment decisions. Unlike traditional trading, which relies heavily on human judgment or preset strategies, AI can:

- Learn from historical data

- Adapt to changing market conditions

- Spot hidden patterns invisible to the human eye

Think of it as having a financial analyst that never sleeps, constantly digesting terabytes of information to suggest the best possible trades.

The Evolution of Trading

- From Floor Trading to Digital Platforms – The old Wall Street image of brokers shouting across the floor has been replaced by trading apps and dashboards.

- Algorithmic Trading – Computers began replacing manual traders by executing trades in milliseconds.

- AI-Powered Solutions – The latest leap integrates deep learning, natural language processing, and predictive models.

The transformation has been as dramatic as moving from horse-drawn carriages to self-driving cars.

Key Features of AI Trading Software

- Real-Time Market Analysis – Scans news, charts, and even social sentiment for opportunities.

- Predictive Analytics – Uses historical data to forecast potential price movements.

- Risk Management – Identifies threats before trades are executed, reducing unexpected losses.

- Automated Execution – Executes trades instantly when conditions are met.

- Customizable Strategies – Lets traders set their risk tolerance and preferences.

Benefits of Using AI Trading Tools

Why are traders turning to AI? Some standout advantages include:

- Speed – Executes trades in milliseconds.

- No Emotional Bias – Eliminates fear and greed that cloud human judgment.

- Deeper Insights – Processes vast amounts of data no single trader could analyze.

- 24/7 Monitoring – Particularly valuable in crypto markets that never sleep.

Risks and Challenges

AI isn’t flawless. Key challenges include:

- Over-Reliance – Blind trust in software can backfire.

- Data Quality – “Garbage in, garbage out.” Bad data equals bad decisions.

- Market Volatility – Black swan events (e.g., the COVID-19 crash) can throw predictions off.

- Regulatory Concerns – Rules differ worldwide, and many governments are still catching up.

Popular AI Trading Software in 2025

In 2025, AI trading platforms range from beginner-friendly apps to enterprise-grade systems. Startups are also carving out niches one emerging example is Digicleft Solution, experimenting with hybrid AI systems for both stock and crypto trading.

AI vs Human Traders

- Humans bring intuition and gut instincts that sometimes outperform data.

- AI offers precision, neutrality, and pattern recognition beyond human capacity.

- The sweet spot is combining both: AI as the tool, humans as decision-makers.

Real-Life Applications of AI Trading

- High-Frequency Trading (HFT) – Executes thousands of trades in microseconds.

- Portfolio Management – Helps investors diversify strategically.

- Crypto & Forex – Thrives in unpredictable, 24/7 markets.

How to Choose the Right AI Trading Software

When evaluating platforms, consider:

- Reliability – Proven track record and uptime.

- Customization – Ability to match your strategy.

- Cost – Subscription fees and hidden charges.

- Support – Responsive customer service and active communities.

The Future of AI in Trading

We’re only scratching the surface. Upcoming trends include:

- Blockchain AI – Transparent, tamper-proof trading systems.

- Quantum Computing – Supercharging predictive analytics.

- Wider Access – Democratizing trading tools for retail investors.

Expert Opinions and Market Predictions

Analysts believe AI trading will be mainstream within a decade. Traders who once resisted automation now embrace it for the competitive edge. Industry reports predict double-digit growth in AI trading adoption by 2030.

Best Practices for Traders Using AI

- Start Small – Test with limited funds.

- Stay Vigilant – Never assume AI is 100% accurate.

- Keep Learning – Markets evolve, and so does technology.

- Use AI as a Partner, Not a Replacement.

Conclusion

AI trading software is no longer futuristic it’s here, reshaping finance at its core. From reducing human error to enabling lightning-fast execution, AI has become indispensable for traders big and small. But success lies in using it wisely: balancing automation with human insight. If you’ve been curious about AI in trading, now is the time. This isn’t just a trend it’s a financial revolution.

FAQs

1. Is AI trading software suitable for beginners?

Yes, many platforms are designed for newcomers with simple interfaces and tutorials.

2. Can AI predict market crashes?

Not always. AI can flag risks, but black swan events remain unpredictable.

3. How much does AI trading software cost?

Options range from free apps to enterprise systems costing thousands per month.

4. Is AI trading legal worldwide?

Yes, but regulations vary by country. Always check local laws.

5. Which markets benefit most from AI?

AI thrives in crypto and forex but also enhances stock and commodity trading.