Imagine a world where you can borrow, trade, or earn interest without relying on a bank. That’s Decentralized Finance (DeFi).

How DeFi Differs from Traditional Finance

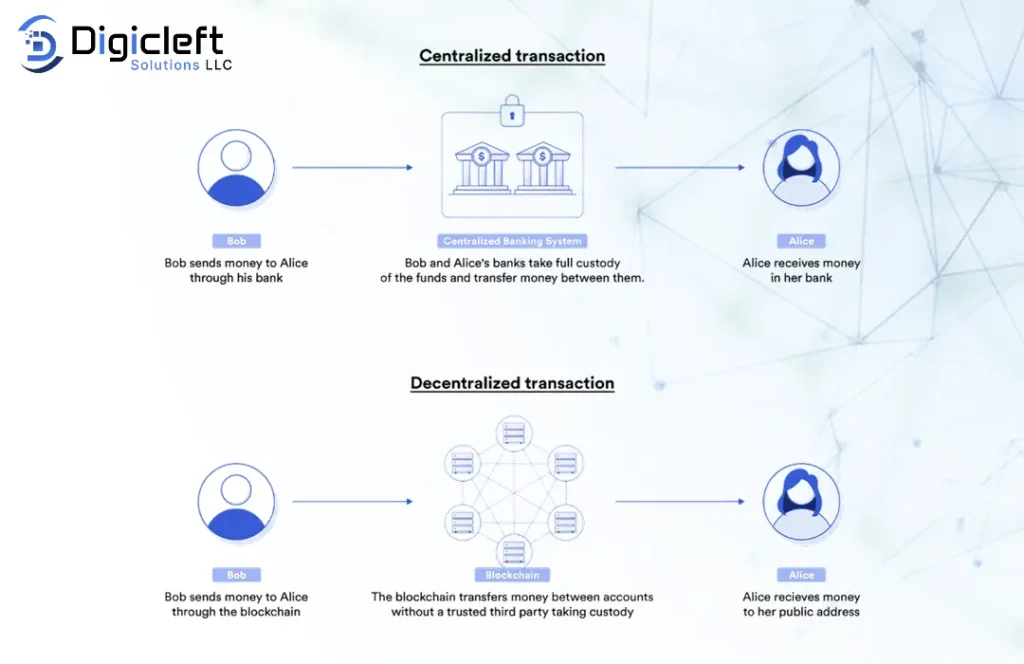

Traditional finance is centralized and controlled by institutions. DeFi flips this model, enabling peer-to-peer, transparent transactions.

Centralized vs Decentralized Systems

- Centralized Finance (CeFi): Intermediaries, limited access, slower processes.

- Decentralized Finance (DeFi): No middlemen, global access, automated smart contracts.

Key Components of DeFi

Smart Contracts

Self-executing agreements with rules embedded in code.

dApps (Decentralized Applications)

Blockchain-based platforms like Aave (lending) or Uniswap (DEX).

Blockchain Platforms

Ethereum dominates, but Solana, Avalanche, and BSC are growing.

Popular DeFi Use Cases

- Lending & Borrowing: Loans via crypto collateral.

- Decentralized Exchanges: Trade without intermediaries (e.g., Uniswap).

- Stablecoins: Pegged to assets like USD.

- Yield Farming & Staking: Earn passive income with higher returns.

Advantages of DeFi

- Accessibility – anyone with a smartphone can join.

- Transparency – all transactions on blockchain.

- High potential returns.

Risks and Challenges

- Smart contract bugs and hacks.

- Market volatility.

- Regulatory uncertainty.

How to Get Started

- Set up a wallet (e.g., MetaMask, Trust Wallet).

- Research DeFi platforms (look for audits & transparency).

- Manage risks (diversify, invest responsibly).

Understanding DeFi Tokens

- Governance Tokens: Vote on protocol changes (e.g., COMP).

- Utility Tokens: Access features/pay fees (e.g., UNI).

- Tokenomics: Study supply, demand, distribution.

The Role of Oracles

Oracles bring real-world data (e.g., price feeds) to blockchain, ensuring smart contracts work properly.

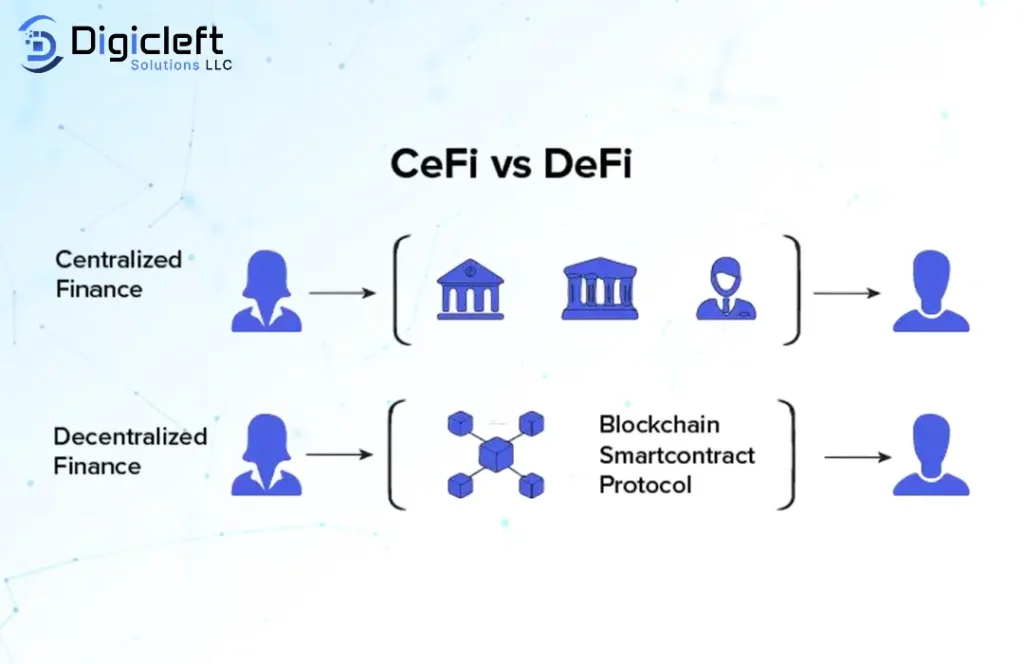

DeFi vs CeFi

| Feature | DeFi | CeFi |

|---|---|---|

| Control | User-controlled | Institution-controlled |

| Transparency | High, on-chain | Limited, opaque |

| Accessibility | Global | Restricted |

| Fees | Variable, often lower | Fixed, sometimes high |

The Future of DeFi

- Cross-chain interoperability.

- Mass adoption with user-friendly solutions like Digicleft.

- Hybrid models integrating with banks and fintech.

Security Best Practices

- Use only audited contracts.

- Enable 2FA.

- Keep private keys secure.

- Avoid unrealistic promises.

FAQs

1. Is DeFi safe? Yes, if using audited platforms and managing risks.

2. Do I need a lot of crypto to start? No, you can start small.

3. What’s a DeFi wallet? A secure wallet to store crypto and interact with dApps.

4. Can I lose money? Yes, due to volatility, hacks, or failures. Invest wisely.

5. How does Digicleft help? It simplifies DeFi with security, smooth transactions, and user-friendly experience.