Ever tried transferring money overseas and felt like half of it got swallowed by “mystery fees”? You’re not alone. Cross-border payments have long been notorious for high transaction costs, slow settlement times, and little to no transparency. For businesses, freelancers, and even families sending remittances, these hidden costs add up quickly.

But here’s the exciting part blockchain technology is rewriting the rulebook. It’s making cross-border payments faster, cheaper, and far more transparent. Let’s break it down and see how it’s can drastically reduce transaction costs and reshape the way money moves globally.

Understanding Cross-Border Payments

To understand the solution, we need to first look at the problem.

When you send money abroad today, it doesn’t just go directly from your bank to the recipient’s. Instead, it takes a detour through a maze of intermediaries banks, clearing houses, correspondent banks, and payment processors like SWIFT. Each one takes a fee, adds a delay, and sometimes even tweaks the exchange rate.

The result? A simple transfer that should be instant ends up taking 3–5 business days and costs anywhere from 5% to 10% of the amount. For a freelancer in India working with a client in the U.S., that’s a big hit.

Transaction Costs Explained

Transaction costs aren’t just the obvious service fees your bank lists. They include:

- Service fees: Direct charges for processing the transfer.

- Currency conversion fees: Hidden charges when converting one currency to another.

- Time delays: While not a “fee” on paper, waiting days for settlement locks up funds and adds indirect costs.

In short, traditional payments are like traveling with too much baggage you pay at every checkpoint.

Challenges in the Current System

- Lack of transparency: You never really know the final amount the recipient will get.

- Multiple intermediaries: Each player adds their cut.

- Compliance requirements: Extra checks mean extra delays.

- Exchange rate volatility: Rates can shift during the process, adding uncertainty.

This complexity is why global businesses often struggle to keep costs down.

Blockchain Technology – A Game Changer

So, what’s it’s , and why is it such a big deal?

At its core, blockchain is a decentralized digital ledger that records transactions securely and transparently. Instead of relying on intermediaries to validate and settle payments, it’s allows direct peer-to-peer transfers.

Key features like decentralization, immutability, and transparency cut down on unnecessary friction, making it perfect for cross-border payments.

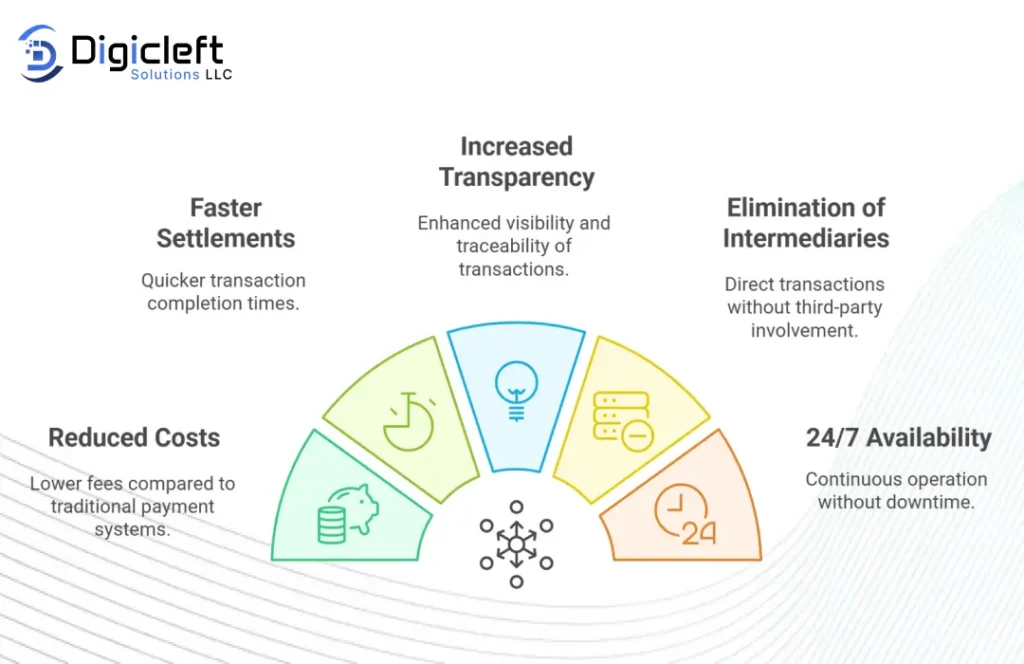

Direct Benefits of Blockchain in Cross-Border Payments

- No intermediaries: Money moves directly from sender to receiver.

- Lower processing fees: Blockchain networks often charge pennies compared to hefty bank charges.

- Instant settlements: Payments that once took days can now clear in minutes or even seconds.

- Full transparency: Every transaction is recorded on-chain, so no hidden surprises.

Cost Reduction Examples

Think about a migrant worker sending $200 home every month. Traditionally, they might pay $15–20 in fees. With blockchain-based transfers, that cost could drop to under $1.

Or consider small businesses importing goods. Instead of waiting for payments to clear through multiple banks, blockchain offers real-time settlement cutting both costs and waiting time.

Use Cases and Real-World Applications

This isn’t theory it’s happening now:

- Ripple (XRP): Focused on instant, low-cost international transfers.

- Stellar Lumens: Designed for microtransactions and remittances.

- CBDCs: Central banks are testing blockchain-powered digital versions of national currencies.

- digicleft solution: Helping businesses integrate blockchain-powered payments to reduce costs and improve efficiency.

The Role of Smart Contracts

Smart contracts are like vending machines for money transfers. Once conditions are met (e.g., funds verified), the payment executes automatically.

This reduces human errors, cuts compliance costs, and removes the need for manual checks. Less paperwork, fewer delays, and lower fees what’s not to love?

Security and Risk Reduction

One reason fees are so high in traditional systems is fraud risk. it’s addresses this with:

- Immutable records: Once entered, data can’t be altered.

- Transparency: Every party can verify transactions.

- No double-spending: Built-in mechanisms prevent fraud.

Lower risk means lower costs across the board.

Adoption Challenges

Of course, it’s not all smooth sailing. Blockchain faces hurdles like:

- Regulations: Different countries have different rules.

- Scalability: Handling millions of transactions per second is still a work in progress.

- Trust: Businesses may be cautious about adopting new tech.

- Integration: Linking it’s with existing banking systems isn’t simple.

But as technology evolves, these challenges are shrinking.

Future of Cross-Border Payments with Blockchain

The momentum is undeniable. Fintech startups, major banks, and even central banks are experimenting with blockchain. As adoption grows, we’re heading toward a world where cross-border payments are instant, affordable, and widely accessible.

Imagine sending money abroad as easily as sending a WhatsApp message. That’s the future blockchain is building.

How Businesses Can Leverage Blockchain Now

If you’re a business dealing with global clients, you don’t have to wait. You can:

- Partner with blockchain-powered payment providers.

- Accept cryptocurrencies for faster settlements.

- Explore platforms like Ripple, Stellar, or digicleft solution.

- Weigh the savings against current banking costs.

For SMEs, this could mean unlocking new markets without bleeding cash on fees.

The Human Side – Why It Matters

This isn’t just about businesses saving money. Lower transaction costs mean:

- Families receiving more from remittances.

- Entrepreneurs having more capital to reinvest.

- Financial inclusion for the unbanked, who’ve been left out of the global financial system.

At the end of the day, reducing costs isn’t just a technical win it’s a human one.

Conclusion

Cross-border payments don’t have to be expensive, slow, and confusing. Blockchain technology is proving that money can move across borders at lightning speed with minimal costs.

By eliminating intermediaries, boosting transparency, and ensuring security, blockchain is shaping a future where sending money worldwide is as simple as clicking “send.” Businesses, individuals, and entire communities stand to benefit and solutions like digicleft solution are already making this future real.

FAQs

- How does blockchain actually cut costs in cross-border payments?

By removing intermediaries, automating settlements, and lowering processing fees, blockchain significantly reduces overall costs. - Is blockchain safe for international money transfers?

Yes. With immutable checks and transparency, blockchain is often more secure than traditional systems. - Will blockchain replace SWIFT and traditional systems?

Not overnight. But over time, blockchain could complement or even replace existing systems as adoption grows. - Can small businesses afford blockchain payment solutions?

Absolutely. Many blockchain platforms are designed to be affordable and scalable, making them accessible to SMEs. - What’s digicleft solution’s role in reducing transaction costs?

digicleft solution helps businesses adopt blockchain-powered payment systems, cutting down costs and improving efficiency in cross-border deals.