Money runs the world, but the way we handle it is changing faster than ever. Enter Decentralized Finance (DeFi) a movement rewriting the rules of the global financial game. No more gatekeepers, endless paperwork, or hidden fees. Just open, transparent, and borderless finance at your fingertips.

But here’s the kick: DeFi just a trend it’s a new paradigm reshaping economies, empowering individuals, and challenging the very core of traditional financial institutions. Let’s dive into what makes it so powerful.

What is DeFi?

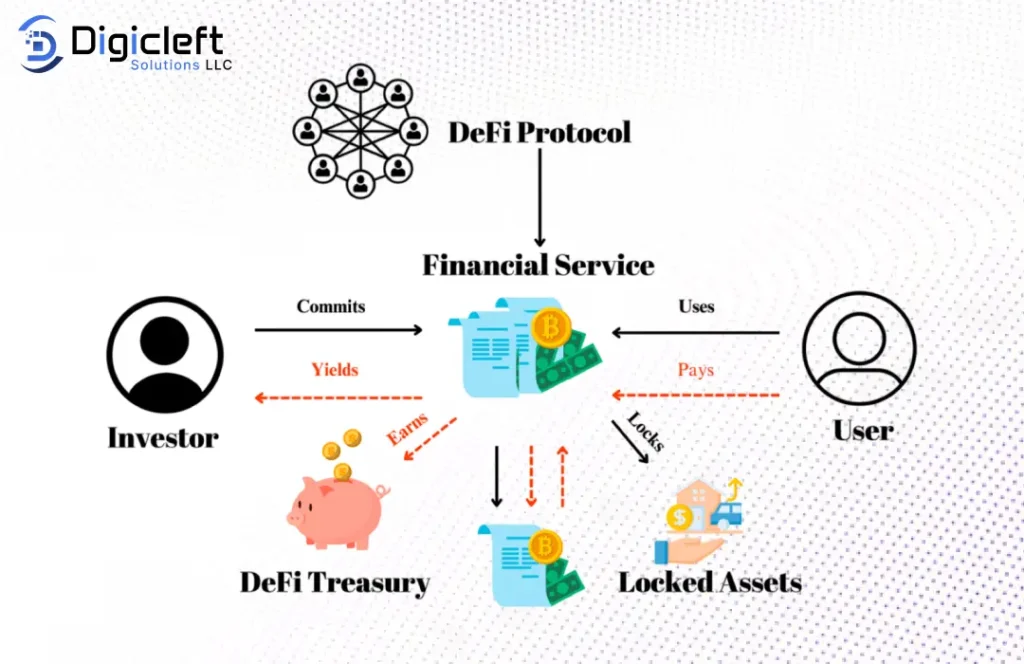

At its core, DeFi stands for Decentralized Finance, an ecosystem of financial applications built on blockchain technology. Unlike traditional banks, DeFi doesn’t rely on intermediaries. Instead, it uses smart contracts self-executing agreements on blockchain.

Think of it as finance without the middleman. Instead of asking permission to move money, you control it directly, with transparency coded into every transaction.

The Core Philosophy of DeFi

- Transparency: Every transaction is visible on the blockchain. No shady fees or hidden terms.

- Accessibility: Anyone with internet access can participate, regardless of location.

- Elimination of Intermediaries: Why pay a bank to send money globally when you can do it in minutes for a fraction of the cost?

How DeFi Works

Blockchain is the backbone. Every record is decentralized and immutable, meaning no one can alter data once it’s written.

Then come smart contracts digital agreements that execute automatically when conditions are met. Platforms like Uniswap, Aave, and Compound showcase this in action, from swapping tokens to borrowing funds instantly.

Traditional Finance vs. DeFi

Banks have been running the show for centuries, but with baggage: long processing times, high fees, and exclusion of billions without access.

DeFi flips the script:

- Deals settle in minutes, not days.

- Costs are lower due to the absence of intermediaries.

- Anyone, anywhere can join the financial system.

Key Components of the DeFi Ecosystem

- Lending & Borrowing Platforms: Apps like Aave let you borrow without bank approval.

- Decentralized Exchanges (DEXs): Platforms like Uniswap allow peer-to-peer trading without central authority.

- Stablecoins: Cryptocurrencies tied to fiat currencies (like USD) provide stability.

- Yield Farming & Staking: Similar to earning interest, but your crypto works within protocols to generate rewards.

The Benefits of DeFi

- Global Accessibility: You only need an internet connection.

- Lower Transaction Costs: Say goodbye to hefty bank charges.

- Financial Inclusion: A lifeline for the unbanked nearly 1.7 billion people worldwide.

- Transparency & Security: Every action is logged on-chain, reducing fraud.

Risks and Challenges of DeFi

- Volatility: Crypto prices can swing dramatically.

- Security Flaws: Hackers target vulnerable smart contracts.

- Regulation: Governments are still figuring out how to handle DeFi.

- Scalability: As more users join, networks like Ethereum face congestion.

DeFi and the Future of Banking

Banks aren’t blind to this shift. Some explore blockchain integrations, while others resist. The most likely outcome? A hybrid financial system where DeFi and traditional banks coexist.

DeFi’s Role in Emerging Markets

- Remittances: Migrant workers can send money home faster and cheaper.

- Small Business Financing: Entrepreneurs in developing nations can access capital without banks.

- Empowerment: People excluded from financial services now have a way in.

Case Studies in DeFi Adoption

- Nigeria: Crypto-powered remittances are reducing costs dramatically.

- Kenya: Farmers are experimenting with DeFi microloans.

- Global Startups: Companies like digicleft solution are integrating DeFi into everyday financial tools.

The Regulatory Landscape

Regulators face a puzzle how to protect consumers without stifling innovation? The U.S., EU, and Asia all take different approaches, but one thing’s clear rules are coming, and they’ll shape the next stage of growth.

How to Get Started with DeFi

- Get a Wallet: MetaMask is the most popular.

- Explore dApps: Start small with exchanges or lending platforms.

- Stay Safe: Use two-factor authentication and never share private keys.

DeFi and Innovation Beyond Finance

- NFTs: Digital art and collectibles use DeFi mechanisms for trading and ownership.

- Gaming: Play-to-earn economies combine DeFi with virtual worlds.

- Tokenized Assets: Real-world properties and stocks can be represented as tokens.

The Future of DeFi: Where Do We Go From Here?

The future looks promising yet uncertain. Will DeFi replace banks? Not entirely. But it will push them to evolve, offering fairer, faster, and more accessible systems. Over the coming decade, expect DeFi to redefine global finance making money more democratic than ever.

Conclusion

DeFi isn’t just an alternative financial system it’s a revolution. With its promise of inclusion, transparency, and freedom, it’s giving individuals control over their money like never before. While challenges remain regulation, scalability, and volatility the momentum is undeniable.

If the last decade was about fintech, the next one belongs to DeFi. And whether you’re a seasoned investor or just curious, now’s the time to explore.

FAQs

Q1: Is DeFi safe to use?

DeFi is still new. While it offers transparency, risks like hacks and scams exist. Always research before investing.

Q2: Do I need a lot of money to start with DeFi?

Not at all. You can begin with small amounts sometimes just a few dollars’ worth of crypto.

Q3: Can DeFi replace banks entirely?

Probably not, but it will push banks to innovate and adapt, leading to a more balanced ecosystem.

Q4: What’s the biggest challenge for DeFi?

Regulation and scalability are two of the biggest hurdles.

Q5: How does digicleft solution fit into DeFi?

Platforms like digicleft solution are leveraging DeFi tools to make financial services more accessible and efficient for businesses and individuals.