Blockchain technology has revolutionized the way we think about assets, power, and trust. One of the most exciting advancements is tokenization, the process of converting real-world assets into digital tokens on a blockchain.

Among the many token standards, ERC3643 is emerging as a frontrunner, offering enhanced compliance and flexibility for modern digital assets. If you’ve been scratching your head over tokenization, this guide will walk you through everything you need to know about ERC3643, and how solutions like Digicleft can make the journey seamless.

What is ERC3643?

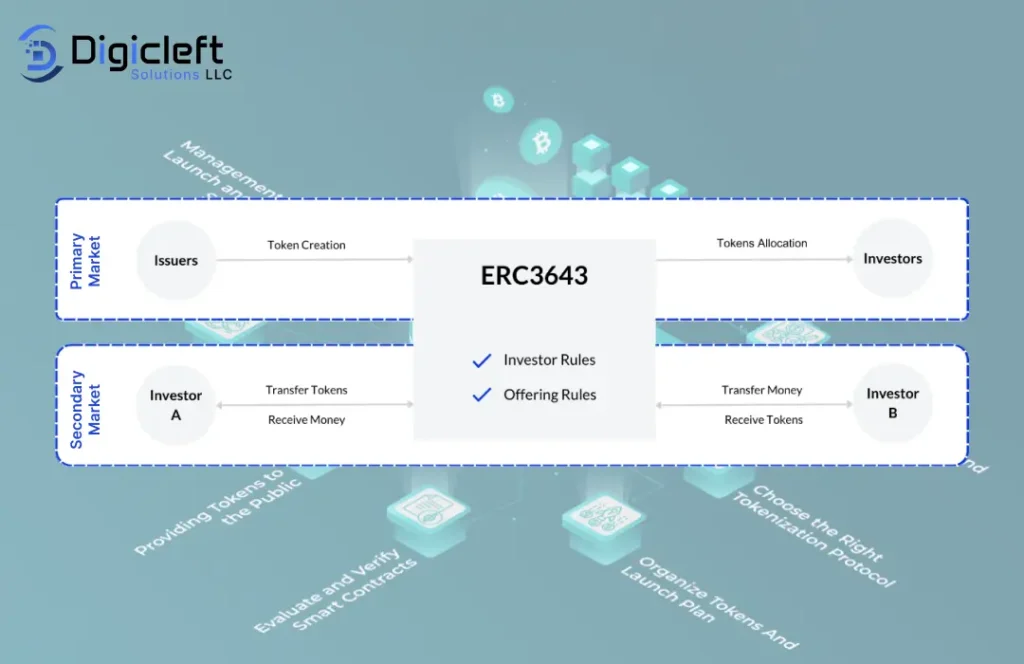

ERC3643 is a token standard specifically designed for regulated tokenization. Unlike ERC20, which is primarily for fungible tokens, or ERC721 for non-fungible tokens, ERC3643 introduces compliance rules directly into the token’s smart contract.

This means aspects like KYC (Know Your Customer), AML (Anti-Money Laundering), and transfer restrictions can be automated.

Key Features of ERC3643

- Compliance Integration – Built-in mechanisms to meet regulatory requirements.

- Permissioned Transfers – Tokens can only be transferred between verified participants.

- Governance Support – Smart contract rules allow voting, revoking, or freezing tokens if necessary.

In short, ERC3643 isn’t just a token it’s a fully compliant digital representation of an asset that plays nicely with the legal world.

Why ERC3643 is a Game Changer

- Enhanced Compliance – Businesses can issue tokens without worrying about breaking financial regulations.

- Streamlined Tokenization – Simplifies converting assets like real estate, bonds, or equities into tokens.

- Broader Adoption – Regulators and financial institutions are more likely to adopt compliant solutions.

The Role of Smart Contracts

- Automated Compliance Checks – Ensures only eligible participants can transact.

- Security – Reduces human error and increases trust.

- Efficiency – Automates repetitive tasks, making transactions faster and cheaper.

Note: Auditing smart contracts is critical to ensure reliability and security.

How ERC3643 Works

- Token Creation – Define the asset, compliance rules, and parameters.

- KYC/AML Verification – Investors are verified before receiving tokens.

- Token Distribution – Tokens allocated to verified participants.

- Transfer Rules Enforcement – Unauthorized transfers prevented by smart contracts.

Technical Components

- Token Registry – Tracks token holders and compliance status.

- KYC/AML Integration – Ensures participants meet legal conditions.

- Governance Mechanisms – Allows rule updates, freezes, or protocol voting.

Use Cases

- Real Estate Tokenization – Enables fractional ownership, increases liquidity, and broadens access.

- Financial Instruments – Bonds, stocks, and derivatives tokenized with regulatory compliance.

- Supply Chain & Trade Finance – Tokens represent goods, ensuring transparency and traceability.

Benefits for Businesses

- Simplified Compliance – Automates legal checks.

- Cost Efficiency – Reduces intermediaries and paperwork.

- Investor Confidence – Transparency attracts more participants.

Challenges & Considerations

- Regulatory Hurdles – Vary by jurisdiction.

- Technical Limitations – Smart contracts are inflexible and errors can be costly.

- Market Adoption – Traditional investors may be slow to adopt.

ERC3643 vs Other Tokenization Standards

| Feature | ERC20 | ERC721 | ERC3643 |

|---|---|---|---|

| Fungible | Yes | No | Yes |

| Compliance Rules | No | No | Yes |

| Governance | Limited | Limited | Advanced |

| Use Case | General Tokens | NFTs | Regulated Assets |

Future of ERC3643

- DeFi Integration – Could fuel decentralized lending and borrowing.

- NFT Hybrid Models – Emerging use cases.

- Mainstream Adoption – More businesses and investors adopting ERC3643.

Implementing ERC3643 with Digicleft

- Token Design – Define compliance rules and asset parameters.

- Smart Contract Deployment – Secure, audited contracts.

- Investor Onboarding – Automated KYC/AML verification.

- Token Management – Monitor transactions, enforce rules, and update governance.

Security Best Practices

- Smart Contract Auditing – Identify vulnerabilities before deployment.

- Multi-Signature Wallets – Prevent unauthorized access.

- Data Privacy – Ensure compliance with GDPR and local laws.

Key Takeaways

ERC3643 tokenization is the future of regulated digital assets. With built-in compliance, businesses can tokenize almost anything from real estate to bonds without legal headaches. When paired with Digicleft, deployment becomes simple and secure.

FAQs

Q1. What makes ERC3643 different from ERC20?

ERC3643 includes compliance, governance, and transfer restrictions, unlike ERC20.

Q2. Can ERC3643 tokens be traded globally?

Yes, but only in jurisdictions recognizing compliant digital asset rules.

Q3. How does ERC3643 ensure compliance?

Through smart contracts automating KYC, AML, and transfer restrictions.

Q4. Is ERC3643 suitable for small businesses?

Absolutely. Platforms like Digicleft make implementation accessible to all sizes.

Q5. What role does Digicleft play?

It streamlines token creation, deployment, compliance checks, and management.